Long-awaited and oft-delayed, Bakkt’s physically settled bitcoin futures are finally on the way. How big an impact will they have?

A year after the launch plans were first announced, on August 16 Kelly Loeffler, chief executive of Bakkt, announced in a Medium post that her company had been cleared by US regulators to launch bitcoin futures.

Bakkt is a subsidiary of Atlanta-based Intercontinental Exchange (ICE), one of the largest exchange groups in the world.

ICE operates futures markets in the United States, Canada and Europe, as well as the world’s largest equity trading platform, the New York Stock Exchange.

From September 23, Bakkt will offer daily and monthly bitcoin futures, both involving physical settlement of the underlying cryptocurrency.

Bakkt’s launch in context

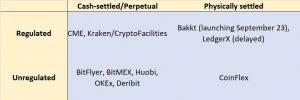

The most widely traded existing bitcoin derivatives are either settled in cash against an index of bitcoin prices, or are perpetual contracts which have no expiry date.

the highest bitcoin derivatives volumes take place on unregulated exchanges based in the Far East

According to self-reported data, the highest bitcoin derivatives volumes take place on unregulated exchanges based in the Far East, such as bitFlyer (Japan), BitMEX (Hong Kong) and OKEx (Malaysia), and involve perpetual contracts.

In late June, for example, BitMEX reported a record trading day of over $13bn in bitcoin derivatives.

Other bitcoin derivatives platforms have taken a different approach: CoinFLEX, a Hong Kong-based exchange, which launched trading earlier this year, says it is providing physical settlement while staying unregulated.

However, Bakkt will allow physical settlement of bitcoin derivatives while staying true to the strict global rules governing futures exchanges.

In particular, this means passing all trades through a central counterparty clearing house (CCP) to guarantee performance, and maintaining sufficient financial reserves to back the CCP.

Four categories of cryptocurrency derivatives

Stealing a march on competitors

Bakkt has also stolen a march on competing projects to launch physically settled cryptocurrency derivatives trading in the US.

On July 31, Coindesk reported that a platform called LedgerX had received a green light from regulators to launch the first such bitcoin futures contracts in the US, apparently beating Bakkt to the startline.

But this turned into a PR disaster for LedgerX.

Embarrassingly, the US Commodity Futures Trading Commission (CFTC), the country’s main regulator of derivatives markets, said immediately that the LedgerX platform had not yet been approved, contradicting the company’s claims.

LedgerX’s PR chief resigned, but the firm’s CEO, Paul Chou, a former trader at Goldman Sachs, launched a public attack against the regulators, saying he was going to sue the CFTC for anti-competitive behaviour and breach of duty.

The importance of physical settlement

Physically settled derivatives are financial contracts where a seller undertakes to deliver the underlying asset to the buyer at a specified future date.

In a cash-settled derivative, there is no movement of any physical asset. Instead, a reference rate or index is used to calculate how much cash changes hands on the settlement date.

Some long-standing futures contracts are physically settled, such as in the markets for agricultural commodities, where futures originated.

Agricultural futures prices incorporate the costs of storing and insuring the commodity for delivery to the contract buyer at a specified date in the future.

But many futures contracts are settled in cash, especially when delivery of the underlying asset is complex, risky or expensive.

However, cash settlement exposes derivatives users to risks, especially when the reference price used to calculate the settlement amounts might be manipulated.

In bitcoin, reference prices from different exchanges have in the past varied by up to 50 percent from one global trading venue to another.

This may have reflected the difficulties of moving money around the world to iron out price discrepancies on those exchanges, rather than overt manipulation.

“Uniquely, Bakkt bitcoin futures contracts will not rely upon unregulated spot markets for settlement prices”

In her statement, Bakkt’s CEO pointed at the difference between her company’s products and those of competitors.

CME, a major competitor to ICE, has been trading cash-settled bitcoin futures since December 2017.

“Uniquely, Bakkt bitcoin futures contracts will not rely upon unregulated spot markets for settlement prices, thus serving as a transparent price discovery mechanism for the benchmark price for bitcoin,” said Kelly Loeffler.

“The importance of [our contract’s] differentiator is only amplified by reports of significant manipulative spot market activity, and other concerns such as inconsistent anti-money-laundering policies and weak compliance controls,” she added.

Cash-settled futures providers respond

The providers of other types of bitcoin futures defended their products.

CME’s cash-settled futures use the so-called Bitcoin Reference Rate (BRR) from CF Benchmarks as their reference price at settlement. The BRR uses bitcoin prices from five different exchanges: Bitstamp, Coinbase, itBit, Kraken and Gemini.

Contacted by New Money Review, the CME declined to comment on Bakkt’s launch plans. However, the CME cited in-house research in which it claimed that the BRR is representative of the underlying bitcoin spot market and provides an accurate reference price.

“The design choices within the methodology makes the BRR highly resistant against manipulation,” said the CME.

But for bitcoin users who wish to hedge against future price movements with a high degree of accuracy—say, bitcoin miners, who are sensitive to small changes in the electricity prices that form the major part of their cost of production—physical settlement appears to offer clear advantages.

Risks and insurance

However, there’s one huge risk in Bakkt’s new undertaking. Using real bitcoin during the futures settlement process means taking custody of the digital currency itself.

Looking after bitcoin safely has proved a tough undertaking, even for computer experts

Bitcoin is a bearer asset, where anyone in possession of the private cryptographic key—a string of letters and numerals—becomes the effective owner.

And looking after bitcoin safely has proved a tough undertaking, even for computer experts.

Thefts of client coins from cryptocurrency exchanges, custodians and other centralised infrastructures have occurred with amazing regularity since bitcoin appeared a decade ago, and may even be accelerating.

Some of these attacks are now state-sponsored, say observers: according to Reuters, citing a confidential UN report, North Korea has earned $2bn in the last year by using sophisticated hacking techniques against banks and cryptocurrency exchanges.

And one past hacking case has a particular historical resonance for Bakkt: in 2016 cryptocurrency exchange BitFinex lost nearly 120,000 bitcoin (around $1.3bn at current market prices) after a security breach.

“Running a bitcoin exchange is like being in a walled, medieval village under siege”

According to Phil Potter, BitFinex’s former COO, the hack came about after his exchange started working with a third party custodian to preempt Bakkt’s launch by three years: BitFinex wanted to create the first platform for physically settled margin trading in bitcoin, said Potter.

Inadvertently, the two companies created a large ‘hot wallet’— a wallet that is connected in some way to the internet—which the hacker then looted.

“I wanted to create a physical delivery mechanism,” Potter said on the What Bitcoin Did podcast.

“We were doing this with [cryptocurrency custodian] BitGo. But neither of us realised we had introduced a vulnerability, and someone was able to take advantage of that.”

“Running a bitcoin exchange is like being in a walled, medieval village under siege. You are constantly under attack,” he said.

To mitigate concerns over the risks to the bitcoin it will hold in custody, Bakkt said last week that it had bought insurance worth $125m to cover clients’ assets. These digital assets will be held in a new subsidiary, called Bakkt Warehouse, the exchange said.

Concerns over the safety of custodied bitcoin were widely cited as the main reason for earlier delays in Bakkt’s launch plans.

But cryptocurrency insurance will come at a cost, and it is unclear how much third parties will charge Bakkt for this coverage. Typically, such storage and insurance costs are reflected in the pricing of futures.

At $125m, Bakkt’s insurance policy also covers less than the amount of bitcoin recently involved in futures trades on the CME.

In June, CME’s cash-settled bitcoin futures recorded a record open interest of 5,391 contracts (26,955 equivalent bitcoin), equivalent to a market value of over $270m.

Impact on the wider financial infrastructure

In her Medium blog post, Bakkt’s CEO mentioned another financial commitment: the exchange is contributing an extra $35m to the existing $68m guarantee fund of ICE Clear US, where the bitcoin futures will be cleared.

Guarantee funds (also called default funds) help CCPs perform their main objective—guaranteeing the performance of all contracts on a regulated derivatives exchange.

If a dealer on the exchange defaults, either on its own or on clients’ positions, the CCP can draw on concentric circles of defence to make sure contracts are honoured and the counterparty to the trade is not affected.

First the margin and default fund contributions of the defaulting clearing member come into play, then the default fund of the CCP, and finally contributions from the remaining clearing members.

But some market observers continue to worry about the financial stability of CCPs, which have gained ‘super-systemic’ status since the 2008 financial crisis.

“Individual clearing houses have failed in the past and if and when they do in the future the social costs will alarm legislators and the public,” the Systemic Risk Council, a private sector body of former government officials and financial and legal experts, warned earlier this year.

“Why should a pension fund bail out those bad boys in bitcoin?”

Some derivatives market participants have also spoken out in the past about adding bitcoin trading to regulated futures exchanges, arguing that the riskiness of the digital asset could compromise the safety of the CCP and, thereby, the banks that are the CCP’s clearing members.

In December 2017, on the eve of the launch of bitcoin futures at the CME, Walt Lukken, CEO of the US Futures Industry Association (FIA), wrote to the CFTC, complaining that the launch had not been subject to proper checks.

“We believe that this expedited self-certification process for these novel products does not align with the potential risks that underlie their trading and should be reviewed,” Lukken said.

“Given the lack of historical data on these products, it is further concerning to clearing members that they will bear the brunt of the risk associated with them through their guarantee fund contributions and assessment obligations, even if not participating in these markets directly, rather than the exchanges and clearinghouses who have listed them,” he added.

The FIA declined to offer additional comment when contacted by New Money Review. But one consultant confirmed that such concerns are real.

“Fungible default funds always lead to friction,” Tim Reucroft, head of research at Thomas Murray, told New Money Review. “Why should a pension fund with positions in gilt futures bail out those bad boys in bitcoin?”

Attracting institutions

But Bakkt is focusing more on opportunities than risks. The exchange says that the addition of physically settled derivatives will play a significant role in the deepening of the bitcoin market by attracting more institutional investors.

“By now, digital asset markets are global and well-developed, but they have largely been designed to serve retail customers rather than institutional participants,” the exchange’s CEO said.

“Today, we’re helping institutions, consumers, policy makers and regulators engage in this emerging market through a trusted, secure and compliant platform,” Loeffler added.

“It can only further the adoption of cryptocurrency”

Even competitors in the cryptocurrency derivatives market participants welcomed the Bakkt launch.

“It’s very exciting,” said Sui Chung, CEO of CF Benchmarks.

“Any new on-ramp for crypto, such as the one-day physical future offered by Bakkt, is very welcome. It can only further the adoption of cryptocurrency.”

“If Bakkt could help pave the way for institutions to enter the crypto trading space it could be of real significance,” Marius Jansen, COO of derivatives exchange Deribit, told New Money Review.

Don’t miss any more New Money Review content: sign up here for our newsletter

Support New Money Review on Patreon or in cryptocurrency